Nov 2023

Never content to be left out of the competition for wealth management of ultra-high-net-worth families from Singapore and Dubai, Hong Kong recently enacted a new tax concession regime (Inland Revenue (Amendment) (Tax Concessions for Family-owned Investment Holding Vehicles) Ordinance 2023) for qualifying single family offices (SFOs) to exempt its family-owned investment holding vehicles (FIHV) and their investment portfolios and special purpose vehicles from Hong Kong profits tax.

While there is no single definition of “family office”, this usually refers to a private corporation formed to serve the various public-facing needs of members of a high net worth family, ranging from investment management to administrative/concierge duties services (legal, tax, accounting, banking) to managing philanthropy. Where the SFO establishes an investment vehicle (FIHV) to invest in approved marketable securities, currencies and other tradeable assets (“Qualifying Transactions”) meeting the minimum asset under management of HK$240 million (roughly US$30 million) NAV, and having adequate substance and expenditure in Hong Kong (a minimum of two full-time local employees and at least HK$2 million local expenditure such as legal or banking fees etc.), upon making an election to the Inland Revenue Department (IRD), profits derived by an FIHV from “Qualifying Transactions” will be charged at a concessionary tax rate (0% for the tax year 2022-23) in Hong Kong with retrospective effect from 1 April 2022, provided that the prescribed conditions are met.

A qualifying SFO and FIHV must be at least 75% to 95% (depending on the ownership structure) directly or indirectly owned by the same “members of family” which broadly refers to all natural persons related to one another including spouses, siblings, cousins, nephews/nieces and their lineal descendants. Qualifying beneficial interest includes those held through family trust where some of the family members are beneficiaries or have a connection or interests to the trusts. Provisions are also in place to recognise multi-layer trust structures for family branches tracing back to a master family trust.

There is no prior vetting by IRD, though advance rulings on qualification may be sought. There is no requirement under the Hong Kong SFO tax concession regime for the family trust, SFO or FIHV to be Hong Kong entities and so offshore trusts and companies formed in the BVI, Cayman Islands or Bermuda may be utilised.

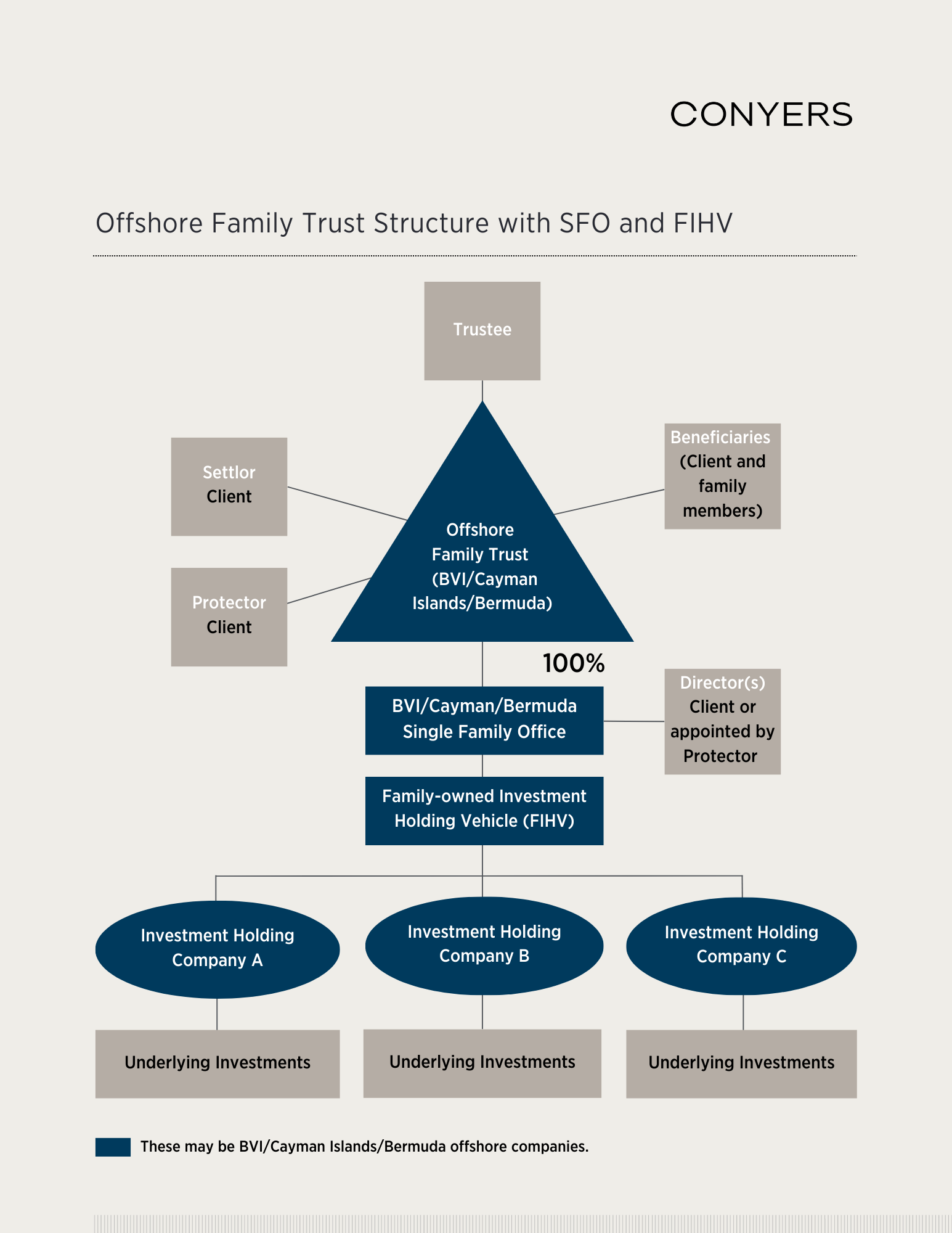

A fixed or discretionary offshore family trust(s) set up in the BVI, Cayman Islands or Bermuda with family members in the beneficiary class, meeting the definition of “members of family“ and eligible to receive distribution of the bulk of the trust assets may also qualify. While no two trusts are identical, a sample offshore family trust holding a SFO and FIHV is as follows:

The benefits of utilising an offshore trust in these jurisdictions are well recognised. Not least of these are its “trust firewall” protection legislation, shielding such trusts from foreign legal attacks on validity or grounds which are not recognised by their own courts. The use of offshore companies as the SPO, FIHV and “Investment Holding Companies” enable them to take advantage of flexible sponsor–friendly corporate legal framework and also exempt them from Hong Kong (or Singapore) stamp duty in sales or re-organisations involving share transfers1.

If they haven’t already done so, this might be a great time and opportunity for interested SFO applicants to first consider their overall estate planning and succession needs by setting up a family trust platform to hold the SFO and FIHV, which may also be incorporated offshore in the BVI, Cayman Islands or Bermuda. Conyers can assist in setting up personalised new offshore family trusts, or review and reorganise mature offshore trusts for suitability. We can also incorporate the SFO and FIHV as local or offshore entities. These offshore resources can help lay the foundational brickwork for the family office structure to take better advantage of the benefits under the new tax concession regimes.

1The corresponding Singapore Resident Fund Scheme under Section 13O or Section 13U of the Singapore Income Tax Act 1947 have similar objectives but different rules – in this context the investment fund (or FIHV equivalent) must be a Singapore incorporated company but there is no requirement that the Singapore SFO or family trust must be formed in Singaproe. Hence our discussions relating to offshore trusts, SFO and Investment Holdings Companies” structure options may be applied to the Singapore regime.