Apr 2018

Eric Flaye, of Conyers, shines a light on the BVI hedge fund structuring options for US sponsors

Many of the initial questions US counsel will have for a sponsor looking to launch a new hedge fund will be about the anticipated investor base, as that factor is fundamental in determining the appropriate fund structure.

The three key categories of investors are: (i) taxable US investors; (ii) tax-exempt US investors; and (iii) non-US investors.

If the anticipated investor base will principally be comprised of taxable US investors, as a general proposition the US sponsor may rely exclusively on domestic jurisdictions (such as Delaware) for all of its potential structuring needs.

However, if the anticipated investor base also includes tax-exempt US investors and/or non-US investors, and such investors represent a material source of prospective subscription capital, the US sponsor may need to include an off shore fund within the broader structure to cater to the particular tax considerations of such investors. This is where the British Virgin Islands (the BVI) – with its unique set of well-regarded, innovative and cost-competitive hedge fund products – comes to the fore.

TAX CONSIDERATIONS OF THE INVESTOR BASE

Taxable US investors: such investors generally prefer to invest in domestic US hedge funds classified as partnerships for US tax purposes (most commonly Delaware limited partnerships or limited liability companies).

Tax-exempt US investors: such investors include certain US pension plans, foundations, endowments and other charitable organisations, and are a material source of hedge fund capital. Passive investment income earned by such investors is generally exempt from US federal income tax; however, this exemption does not extend to ‘unrelated business taxable income’ (UBTI). In the context of hedge funds, the key potential source of UBTI is earnings arising from debt financed investment activities (i.e. trading on margin). If a tax-transparent entity such as a typical domestic hedge fund earns any UBTI, its investors shall be treated as though they earned such UBTI themselves, which may result in US tax liabilities for those otherwise tax-exempt US investors who invest in the domestic fund.

In contrast, off shore entities (such as a typical BVI fund) classified as corporations for US tax purposes can effectively ‘block’ any such attribution of UBTI as they are not tax-transparent vehicles. If the BVI fund earns any UBTI, the character of that income is not passed through or otherwise attributed to its investors. Th is ‘blocking’ effect is the principal reason tax-exempt US investors generally prefer to invest in off shore funds.

Non-US investors: such investors generally prefer to invest in off shore funds classified as corporations for US tax purposes so as to keep out of the US tax net (and avoid any attendant requirement to file US tax returns).

IS AN OFFSHORE FUND MERITED?

Having identified potential tax-exempt US investors and/or non-US investors within the anticipated investor base, the sponsor will then have to determine whether an off shore fund is warranted from a cost-benefit perspective, taking into account: (i) the potential capital to be raised from such investors; (ii) the preferred timing of such capital contributions (e.g. are such investors important seed/anchor investors, or can they instead be courted and the off shore fund established at a later stage once fund AuM hits critical mass?); and (iii) the incremental formation and maintenance costs of the off shore structure and their expected impact on the fund’s performance returns and track record.

The BVI is often regarded as the leading blue-chip jurisdiction from the perspective of this value equation as it is a comparatively quick, painless and cost-competitive domicile in which to establish off shore hedge funds.

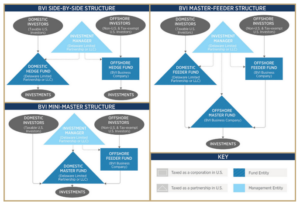

OFFSHORE HEDGE FUND STRUCTURES

There are three principal structuring options for an offshore hedge fund. The appropriate structure will depend primarily on the particular trading strategy, investment and tax considerations of the investor base, and preferred tax treatment of the investment manager’s performance compensation.

Side-by-side structure: taxable US investors invest directly in a domestic fund which in turn invests in an underlying portfolio of securities. Tax-exempt US investors and non-US investors invest directly in an offshore fund which in turn invests in a separate underlying portfolio comprised of the same or substantially similar securities as the domestic fund. This structure necessitates at least two new fund entities, which are separate but operate in parallel under common management.

A side-by-side structure affords the manager flexibility to implement different trading strategies for the domestic and offshore funds, which may be beneficial if onshore and offshore investors have different investment and/or tax considerations. Side-by-side structures are often comparatively cheap to establish and simple to administer from an accounting perspective; however, they can require duplicative trading (or splitting of trade tickets) and administration work and result in different performance results between the domestic and offshore funds, and may not be appropriate or efficient for funds with trading-intensive strategies. Side-by-side structures are often used for fund-of-funds strategies but are otherwise relatively uncommon.

Master-feeder structure: taxable US investors invest directly in a domestic feeder fund which in turn invests all its assets in an offshore master fund. Tax-exempt US investors and non-US investors invest directly in an offshore feeder fund which in turn invests all its assets in the same offshore master fund. The offshore master fund then invests in one common underlying portfolio of securities. This structure necessitates at least three new fund entities. A master-feeder structure results in one common trading strategy and common performance results, and avoids duplicative trading and administration work. While such structures are commonly used by the more established hedge funds, they are comparatively complex and expensive to establish and may not be appropriate if onshore and offshore investors have different investment and/or tax considerations.

Mini-master structure: taxable US investors invest directly in a domestic master fund. Tax exempt US investors and non-US investors invest directly in an offshore feeder fund which in turn invests all its assets in the same domestic master fund. The domestic master fund then invests in one common underlying portfolio of securities. This structure necessitates at least two new fund entities.

A mini-master structure results in one common trading strategy and common performance results and is cheaper to establish than a master-feeder structure. The key downside is that if any US regulatory restrictions apply on the maximum number of investors in the domestic master fund, the number of investors in the offshore feeder fund will also be counted towards this threshold.

In contrast, no such investor look-through applies to master-feeder structures.

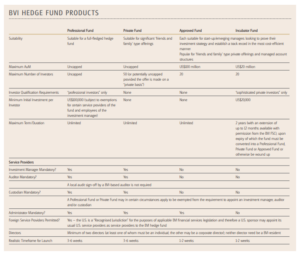

BVI HEDGE FUND PRODUCTS

A typical BVI hedge fund will be open-ended in nature – by virtue of providing its investors the right to withdraw capital at periodic intervals by reference to the net asset value of the fund – and therefore will be subject to regulation by the BVI Financial Services Commission. In contrast, a typical private equity or venture capital fund is closed-ended and therefore generally not subject

to direct regulation in the BVI.

BVI funds may be incorporated as business companies or formed as limited partnerships or unit trusts. The business company, being a corporate vehicle, is by far the most common structure for BVI hedge funds.

BVI regulated fund products potentially suitable for use as offshore hedge funds include Professional Funds, Private Funds, Approved Funds and Incubator Funds. The following table outlines some of their key characteristics.

As illustrated above, the BVI offers a diverse set of offshore hedge fund products, suitable for the full gamut of sponsors from start-ups all the way up to institutional managers with established track records and significant assets under management, and is the logical choice for those sponsors who wish to signal to their investor base commitment to quality as well as costs discipline.

This article was first published in [HFM Week]1 How To Start a Hedge Fund in the US 2018.

1: http://hfm.global/hfmweek/